Income-driven repayment (IDR) plans are government programs available to federal student loan borrowers that allow borrowers to tie their monthly student loan payments directly to their income. In other words, the lower your income, the lower your monthly payments (possibly as low as $0 per month).

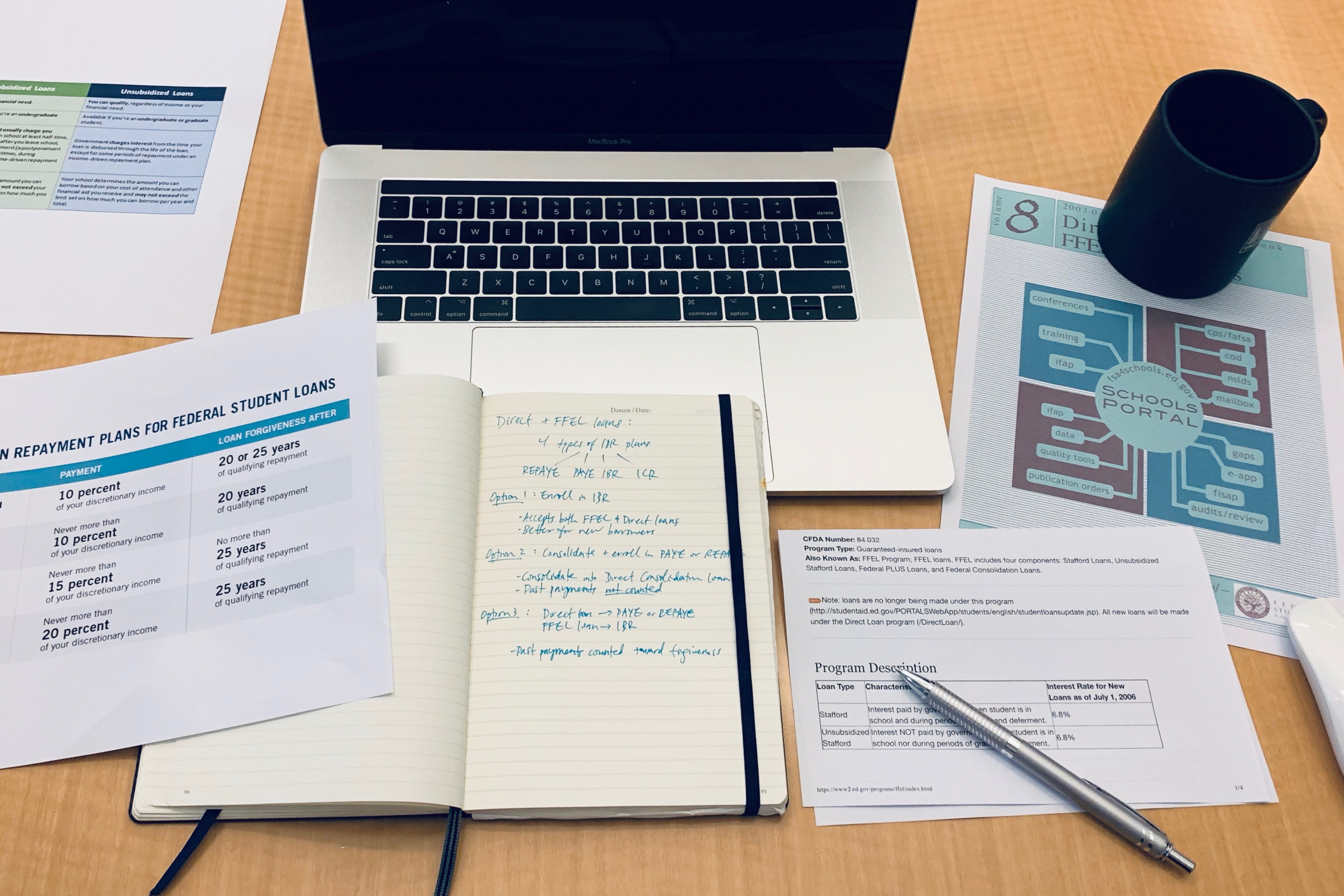

It’s important to note that income-driven repayment is the umbrella term that encompasses four types of plans, each with their own nuances (IBR, ICR, PAYE, and REPAYE). For a more general guide to income-driven repayment plans, check out our IDR guide first.

In this post, we are going to explore the options that are available to borrowers with both new loans (also known as Direct loans) and older loans (also known as FFEL loans). This is a topic that is understandably confusing to many borrowers with both types of loans. Use this blog as a guide so that you understand all of your options before choosing an income-driven repayment plan.

Option 1: Enroll in IBR

First off, it’s worth noting that Direct loans (except for Parent PLUS loans or Consolidation loans that included a Parent Plus loans) generally qualify for all four of the income-driven repayment plans, while FFEL loans (except for Consolidation loans that included a Parent Plus loan) only qualify for one of the income-driven repayment plans: IBR. Therefore, if you have both Direct and FFEL loans, you can enroll in IBR, which accepts both FFEL and Direct loans. As a result, this may be the plan that your loan servicer automatically slots you into without considering your other options.

Whether IBR is a good option for you depends on whether you are a “new” or “old” borrower. For “new” borrowers (all loans taken out on or after July 1, 2014), your payments would only be 10% of your discretionary income. For “old” borrowers (any loan taken out before July 1, 2014), your payments would be 15% of your income, which is likely more than what you could be paying under a different plan. Options 2 and 3 below lay out how you could be paying less each month.

Option 2: Consolidate your loans and enroll in PAYE or REPAYE

Consolidating your loans is simply the act of converting one or more of your loans into a single “Direct Consolidation loan.” If you consolidate your FFEL loans into a Direct Consolidation loan, then you would qualify for the PAYE or REPAYE plan, both of which allow you to pay only 10% of your income, which is great!

Things get a bit more complicated if you’ve already been making payments on your FFEL loans. You should consider the number of payments that you’ve already made on your FFEL loans because previous payments toward these loans may count toward your forgiveness under other income-driven repayment plans. Consolidating your FFEL loans into a Direct Consolidation loan, on the other hand, effectively “erases” your past payments, as they are no longer counted toward forgiveness.

Here’s an example: If you’ve been making payments under a Standard 10-year plan for three years and decide to enroll in the IBR plan for new borrowers, you would receive forgiveness in 17 years (as opposed to the full 20 years) because you would receive credit for the 3 years you’ve already been in repayment.

On the other hand, if you were to consolidate your FFEL loans into a Direct Consolidation loan and enroll in PAYE or REPAYE, the 3 years of payments you’ve already made on your FFEL loans would not count toward your forgiveness. Therefore, you would need to pay for the full 20 years before receiving forgiveness.

If you haven’t started paying your FFEL loans yet or have only made a few payments, “erasing” these past payments won’t be a concern for you. If you have already been making payments under a Standard 10-year plan for several years, however, and you don’t want to lose credit for those payments, then option 3 may be better for you.

Option 3: Put your Direct loans into PAYE or REPAYE, and put your FFEL loans into IBR

If you want to maintain credit for past payments that you’ve made under a Standard 10-year plan, your best option may be to put your Direct Loans in PAYE or REPAYE while putting your FFEL loans in IBR. This allows you to count your past payments under each respective income-driven repayment plan. By not consolidating your loans, your past payments are counted toward forgiveness, which can shorten your overall repayment timeline.

The pros and cons of all three of these options depend on your past and current situation. If you have both FFEL and Direct loans, be sure to make an informed decision about your choice of income-driven repayment plans based on the tradeoffs outlined above.

Summer is developing tools to help identify the best options available to borrowers. If you’d like to see which options are available to you, create an account and let us help you analyze your loan situation and get you enrolled in the right programs for your individual situation.

.jpg)